Buy Now, Pay Later Growing in Popularity

How retailers are implementing buy now, pay later options this holiday season

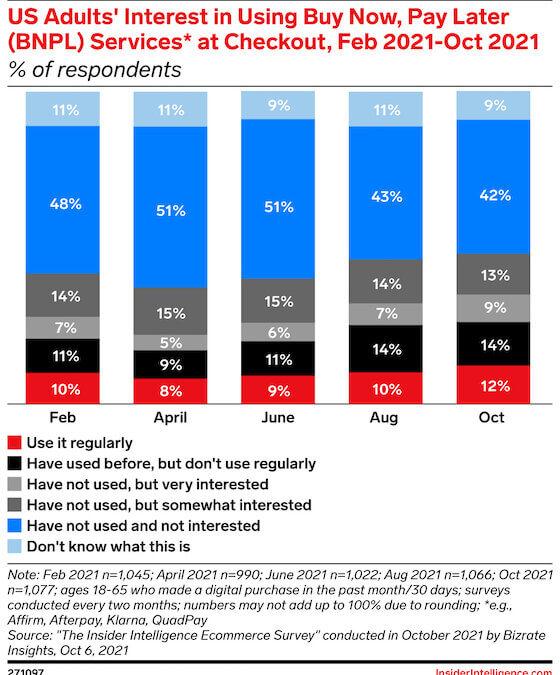

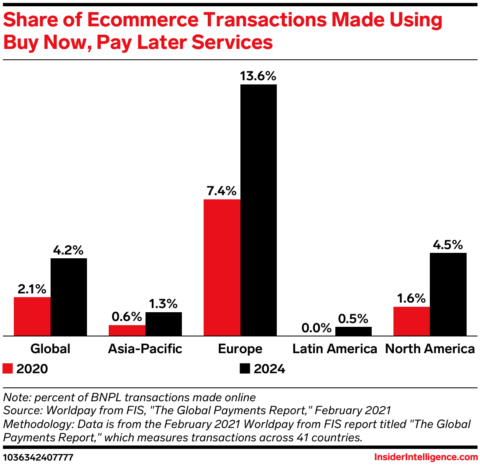

Shoppers are being encouraged to take advantage of buy now, pay later (BNPL) options to offset some of the stress from a shopping season marked by strong consumer demand, rising inflation, product shortages and smaller discounts from retailers.

Also there is a new trend emerging, BNPL is moving from online to in-store. This year, US holiday retail sales will hit a record $1.147 trillion with 81.6% of that coming from in-store shopping.

Although the figures shown are from US research as we all know, what happens stateside inevitably crosses the water and arrives on our shores here in the UK. So worthwhile considering!

Increasing the availability of BNPL in stores via retail partnerships will be critical to getting providers in on the return to in-person shopping during the peak holiday season.

- Klarna has announced agreements with major US mall operators Macerich and Simon as well as Macy’s and FreedomPay, to expand in-store BNPL offerings. At Macy’s, for example, shoppers can pay for purchases with one-time virtual cards created in the Klarna app and stored in their digital wallets.

- Afterpay is sending shoppers on augmented reality (AR)-linked scavenger hunts through select Westfield shopping centers to unlock holiday deals via QR codes that can be redeemed at mall retailers that accept Afterpay.

- For the first time in its 60-year history, Walmart is doing away with traditional layaway plans in favor of BNPL, thanks to its partnership with Affirm, which will be promoted via TV walls in more than 3,900 Walmart stores. Prominent placement of BNPL offerings in stores will also help expand the user base to draw in consumers who make fewer purchases online, such as the typical Walmart consumer who is in the 55-to-64 age range.

- According to Deloitte’s 2021 Pre-Thanksgiving Pulse Survey, 30% of respondents plan to use BNPL to stretch their holiday budgets, compared with 35% who will use credit cards. Additionally, a Morning Consult survey found 35% of BNPL shoppers expect to spend $500 or more on their installment-plan holiday purchases, compared with 25% of respondents overall.

Initial reports from Cyber Week indicate these strategies are working. PayPal CEO Dan Schulman said there were more than 750,000 BNPL transactions on Black Friday, a nearly 400% year-over-year (YoY) increase, while Afterpay reported a 34% increase in orders on Black Friday and Cyber Monday with in-store transactions up 442% YoY.

Equifax to include short-term BNPL plans in credit reports next year as regulation takes shape

Starting next year, Equifax will include pay-in-4 buy now, pay later (BNPL) plans within credit reports, per The Wall Street Journal.

Technically, although many if not all, are interest-free and the attractive element of the option is the ability to spread the cost over a longer period they can cause concern for credit rating agencies and impact on credit reports.

The reports will include plan opening dates, the transaction amounts that users agree to pay, and the actual payment that is made. Similarly, TransUnion and Experian said they are working with BNPL providers to include more instalment-loan data in credit reports.

- The quickly shifting nature of these transactions can create technical challenges when it comes to reporting. Many credit reports aren’t able to record biweekly payments, and accounts are often frequently opened and closed, which can hurt a user’s score.

- Additionally, there’s often a lag between consumer account-opening and when lenders submit that information to be included in credit reports—and this time gap can go beyond a repayment period, which may create accuracy problems.

Te bigger picture: Historically, BNPL plans have been largely unregulated—but that’s starting to change as the financial risks involved with BNPL, especially missed payments, become more prominent.

In the US, the Consumer Financial Protection Bureau recently opened an inquiry into major BNPL firms to determine risks and benefits of their solutions. If the data collected from the CFPB probe suggests that BNPL offerings pose risks to consumers, there will likely be targeted regulations for providers next year—which would be in line with our prediction. Efforts by credit reporting agencies like Equifax may support emerging BNPL regulation.

CFPB takes aim at BNPL’s ‘Big Five’ to mitigate consumer financial concerns

The Consumer Financial Protection Bureau (CFPB) opened an inquiry into Affirm, Afterpay, Klarna, PayPal, and Zip to determine the risks and benefits of buy now, pay later (BNPL) products, per a statement. The CFPB will work with international partners in major markets as part of the inquiry, and companies have until March 1, 2022 to report industry practices to the consumer watchdog.

- Debt accumulation. The statement noted that BNPL products are becoming increasingly easy to use for any purchase. Consumers can also have multiple BNPL plans with various providers—making payments easy to lose track of.

- Regulatory arbitrage. The CFPB claims that some BNPL firms may not be appropriately evaluating what consumer protection laws apply to their products, and they might also not provide customers with adequate disclosures and protections.

- Data harvesting. The bureau wants to understand how providers collect customer data, what they do with it, and how it benefits them financially.

Forty-four percent of US consumers have used a BNPL solution, and out of this group, 34% have missed one or more payments, according to recent data from Credit Karma. Of those who have missed payments, 72% say they believe their credit score declined as a result.

Surging BNPL use during the pandemic—when many consumers opted to use less credit and embraced flexible payments—was likely the driving force behind the CFPB’s probe. And the recent upswing in use over the holidays may have been the tipping point for the watchdog: PayPal reported a 400% year-over-year increase in BNPL use on Black Friday, for instance.

If the data collected from the CFPB probe suggests that BNPL offerings pose risks to consumers, there will likely be targeted regulations for providers next year. This would be in line with our 2022 prediction that the bureau would take a more aggressive push to ensure providers comply with consumer protection laws.

Regulators in the UK and Australia are also sharpened their focus on BNPL providers in light of data suggesting the risks involved with their offerings. Their moves could foreshadow what BNPL regulation might look like in the US.

- In February, the UK’s Financial Conduct Authority announced that it would begin regulating BNPL products following a report that highlighted consumer risks with the offerings.

- And earlier this month, Australian Treasurer Josh Frydenburg released several regulatory proposals that would affect BNPL solutions.

Good or Bad Development

Like most developments, there are pros & cons for both consumers and retailers.

It offers consumers a way to spread the cost over, usually 3 months. The benefit is clear; it is often said that if you can ‘afford’ any purchase, then buy it on credit.

Maybe not as relevant in recent times with interests rates at current low levels but in past times from a discounted cash flow perspective there was an advantage. It could still be a valid consideration with the ability of an interest-free loan albeit for a relatively short period.

The ‘cons’ may be more on the retailer’s side particularly if there are no real credit checks. It is more likely that consumers will consider a BNPL (buy now, pay later) option when the purchase is over a perceived value where even a split over 3 months could leave a relatively large balance after the first payment instalment.

Read full article: How retailers are implementing buy now, pay later options this holiday season

Read full article: Equifax to include short-term BNPL plans in credit reports next year as regulation takes shape

Read full article: CFPB takes aim at BNPL’s ‘Big Five’ to mitigate consumer financial concerns